Prior to importing goods, agencies should conduct a thorough analysis of all customs guidelines and requirements, including any restrictions and the necessary documentation. Clearing agents/customs brokers and national authorities can help guide importers on the steps and documentation required. In emergencies where a national Logistics Cluster is activated, participating members can also share import relevant information as needed. In any situation – emergency or not – there should be a clear understanding of what steps are required and a clear plan of how to move.

It should be noted that this process may be altered in the face of rapid-onset emergencies, but not always.

Upstream Planning

As the need for international shipments develop, there are key steps that any organisation or entity initiating shipping will need to undergo. Response organisations acting as exporters/shippers will need to take key actions to obtain information and coordinate shipments:

| Data Required from Requestor/Receiver |

|

|---|---|

| Shipment Preparation and Organization |

|

| Strategies for Emergency Response Organisations |

|

Downstream Planning

An organisation or an entity acting as importer or consignee intending to receive a shipment should also take steps to properly prepare and identify needs.

| Defining the Importation Process |

|

|---|---|

| Preparing to Receive Shipments |

|

| Possible Customs Specific Regulations for Importation |

|

| Strategies for Emergency Response Organisations |

|

Documentation

The import process usually requires specific, and at times substantial documentation.

In emergencies, the authorities will usually ask for originals or copies of the following documents:

- Commercial / Proforma Invoice – Indicates an overview of the contents of the shipment and the party responsible for procuring / paying for the cargo. Invoices typically list a total cargo cost which can be used for customs duty purposes. Many humanitarian agencies prefer to use self-generated proforma invoices to specifically indicate that the cargo will be used for humanitarian aid.

- Packing List – Should be detailed and accurate enough that customs officials don’t need to inspect every item. Packing lists are typically far more detailed than invoices when shipments have a large number of line items.

- Bill of Lading / Airway Bill / Rail Waybill / Trucking Waybill.

Other Import documentation often required:

- Letter/Certificate of Donations and/or Humanitarian Goods - Many agencies will included self made letters of humanitarian intent or donation to help facilitate the customs exemption process.

- Proof of duty exemption - May be required at the time of clearance, usually a registered humanitarian agency should be able to obtain some form of letter from the relevant tax revenue authority. A letter may be required for every import, however.

- Certificates of Origin (COO) - Usually generated and certified by the manufacturer, but can be done by the sending agency if required. Some countries have strict source origin requirements.

- Certificates of Inspection (COI) - COIs are usually associated with regulated commodities that may be consumed by humans - example: Medication - or may have adverse effects on human health - example: flammable plastic shelter material. COIs typically require certification from an outside laboratory testing facility, certified to test the specific chemical properties of the items in question.

- Certificates of Conformity (COC) - COCs are used to confirm that products meet or exceed a certain industry standard, and require inspection by outside testing and certifying companies.

- Phytosanitary Certificates - Certification attesting that imported plant based material meets the sanitary requirements of the country in question, usually from an outside laboratory.

- Special handling instructions (dangerous goods, cold chain, drugs, food).

Port of Entry Procedures

Most large seaports and international airports have the capacity to carrying out customs inspections, storage and clearance on site. For customs clearance to be official, there will need to be offices designated to the relevant customs authority and space for storage of goods undergoing customs.

The main formalities connected with the handling of goods by authorities in the export or import trade are as follows:

- Before any cargo is has a copy of the cargo manifest/packing list and BOL/AWB must be delivered to the relevant customs and port/airport authorities.

- When cargo is discharged and offloaded from the ship/aircraft, it will be counted by a designated agent on the ground.

- Wharfage and/or ground handling fees at the prescribed rates is levied on all goods arrived.

- Goods not removed from the custody of the customs authorities within the free storage period allowed are charged rent at the prescribed demurrage rate.

- Demurrage will be charged on any un-manifested cargo not removed within the prescribed time after delivery.

- Failure to cover demurrage fees may ultimately result in cargo being sold at public auction.

- Demurrage fees may be waived in cases of:

- Goods arriving in a damaged condition for which a claim is made against the carrier, some extension of free time may be allowed to enable a survey of the damaged cargo to be made.

- Goods damaged subsequent to offloading and for which an "Application for Survey" has been received by the port authorities.

- Goods are detained by the customs authorities for special examination, chemical tests, etc.

- Removal of goods is delayed due to no fault or negligence on the part of the importers.

- Areas used for the offloaded and storage of imported goods must be declared as Customs Areas under a Customs Act, and usually are bonded, highly secure facilities.

- Storage of hazardous cargo will be permitted only in locations specially designated for that purpose.

- Examination of cargo by Customs will be permitted only if the consignee or clearing agent produces to the port authorities the delivery order issued by the shipping agent together with the Bill of Entry prepared on behalf of the consignee.

For cargo arriving by air:

- Larger airports usually provide facilities inside designated Customs Areas for transit cargo to be de-consolidated and consolidated with local export cargo.

For arriving by sea:

- In the case of containerised cargo, containers may be unstuffed in the port area before the cargo is presented for examination by Customs. Alternatively, containers may be taken to an inland container depot, or warehouse, or factory of the consignee where they are unstuffed and delivered to the consignee after completing Customs formalities.

- Carting or transporting of export cargo, if it is Break Bulk, is permitted at the berth where the ship is ready to load. In the case of containerised cargo, carting is permitted to the location assigned to the shipping line by the port authority.

- Like imports, exports attract demurrage after the expiry of free time but port authorities sometimes waive this charge in the case of special cargo. Ports may defer acceptance of export cargo if there is a delay in the arrival of the vessel.

- When export cargo is taken to an inland clearance depot, Customs formalities are completed there and the cargo is stuffed into containers, which are then brought to the port for direct loading onto the ship. The same procedure may also be followed if containers are stuffed at the factory or warehouse of the shipper.

When planning arrival of cargo, it is extremely important to know if customs is an option, especially in post rapid-onset emergencies. There may be instances where planes or boats may be physically able to arrive at a seaport or airport, but not actually able to legally import goods.

Clearing Goods

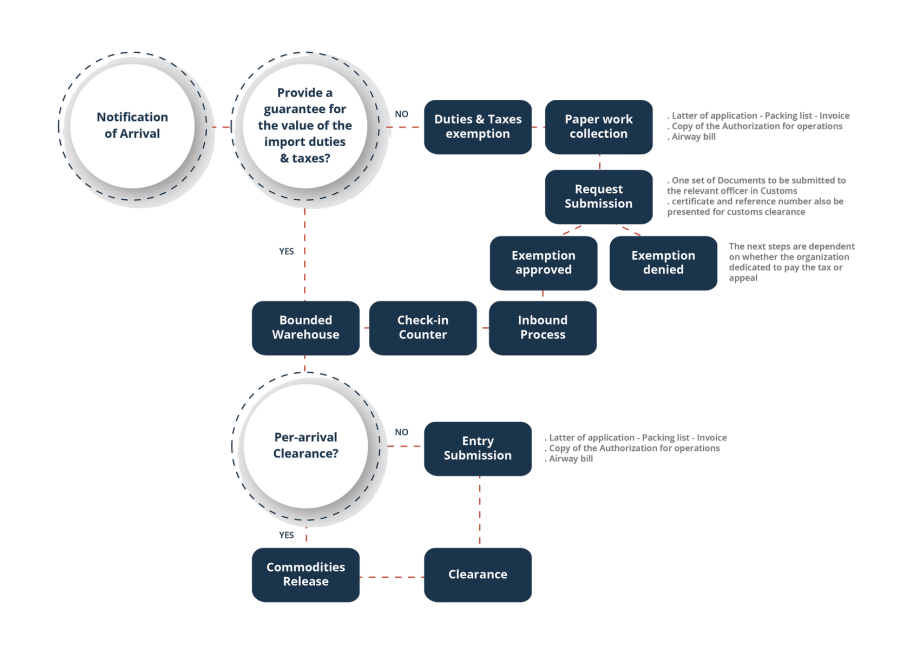

The following steps detail the process through which cargo is handled and inspected by customs after arrival and offloading:

- All imported cargo must be offloaded at a designated Customs port and should not be removed from customs control without written permission of the customs authorities.

- Before permission is given to remove goods from customs control, the owner or agent acting on the owner’s behalf is required to submit documentation as required by law, in the prescribed form to enable customs authorities to examine the goods. The specific cargo details must match across all documents.

- When goods are destined for bonded warehousing, application for permission to warehouse those goods and a bond must accompany the documentation.

- Customs authorities are empowered to examine all imported goods. The examination may be physical (visual inspection, counting, weighing, measuring, chemical test, etc.) or documentary (involving examination of relevant documents such as invoices, bankers' notes, insurance policies and forms listing the quantity and description of goods).

- If goods are dutiable, either customs tariffs must be paid at the time or the importer must give a bond to guarantee payment of the duty.

- If goods are not removed within the prescribed period after the arrival of the importing vessel or aircraft, they are liable to be sold at public auction by the port authorities who will recover from the sale proceeds all charges due to them, including customs duty.

- Customs authorities are entitled to recover from the importer any shortfall in duty levied or erroneous refund of customs duty, in accordance with prescribed procedures and laws.

- In cases where import licenses are required, customs authorities will check the legality of the imported goods against those licenses.

- Once the local customs authority has deemed all paperwork and payment sufficient, the consignee or consignee's acting agent will be able to pick up cargo from the designated cargo facility.

Customs authorities will use paper copies of all associated documentations - and depending on the context and the capacity of the customs authority, electronic copies - to identify cargo going through the physical inspection process.

If the importer or the customs broker acting on their behalf fails to obtain paperwork by the time customs clearance should begin, the submission procedure will be delayed, and the release of cargo will be delayed or not happen at all. The consequences of frustrated cargo result in delays in the delivery to beneficiaries, or additional costs such as demurrage. Within a short period of time, large amounts fees can accumulate for which the receiver is held accountable.